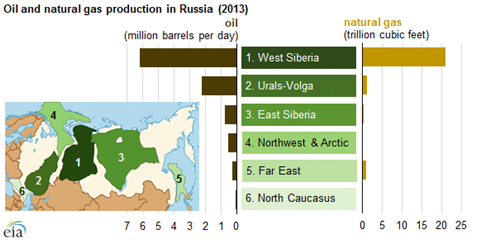

Russia was the world’s largest producer of crude oil (including lease condensate) and the world’s second-largest producer of dry natural gas in 2013. In 2013, production of crude oil and lease condensate grew by 1.3%, and production of dry natural gas grew by 2.1%. Most of Russia’s crude oil and natural gas production occurs in West Siberia, a part of central Russia that stretches from the northern border of Kazakhstan to the Arctic Ocean. However, new technologies, growing Asian markets, and Western sanctions have the potential to shift the regional balance of Russian oil and natural gas production in the long term.

In 2013, production of oil and natural gas in West Siberia totaled 6.2 million barrels per day of crude oil and 21.1 trillion cubic feet (Tcf) of natural gas, respectively, down from peak production levels in the 1980s. Russian energy companies Rosneft and Gazprom Neft have increased the efficiency of older fields in West Siberia by implementing technologies like multiple leg horizontal drilling and multistage hydrofracking; however, further increasing West Siberian production will require substantial investment. Consequently, Russia is considering developing its significant but less-accessible reserves in previously undeveloped regions.

Offshore production. Russia recently began offshore oil production in the Arctic for the first time. Gazprom Neft began commerical operations at its Prirazlomnoye rig in the Pechora Sea in December 2013, and ExxonMobil-Rosneft began exploratory drilling at the Universitetskaya-1 well in the Kara Sea in August 2014. According to Gazprom Neft and ExxonMobil-Rosneft, the two formations are estimated to hold 600 million and 9 billion barrels of technically recoverable oil, respectively.

New export markets. Along with increasing production, Russia seeks to diversify its export market by meeting growing energy demand in China. Russian energy exports have historically been consumed by developed markets in Europe, but high economic growth has led to increased demand from developing markets in Asia, particularly China. Gazprom earlier this year finalized a deal to supply China with up to 1.3 Tcf per year of natural gas starting in 2018. The natural gas will mainly come from fields in East Siberia.

Incentives. The Russian government has offered tax holidays and lower export tariffs to Russian companies that have expanded operations in East Siberia and the Northwest and Arctic region. The startup of the East Siberian Vankor oil and natural gas field in 2009—the largest oil discovery in Russia in nearly three decades—contributed to Russia’s increase in oil production since 2010. Offshore reserves in the Far East could also play a larger role in offsetting declining production in older fields.

Sanctions. U.S. and European Union (EU) sanctions (implemented prior to September following Russia’s involvement in the separation of Crimea from the control of Ukraine, and its subsequent involvement in support of separatist activities in parts of Eastern Ukraine) restrict Russia’s access to foreign technology and capital, and prevent Russian energy companies from entering into joint projects with foreign energy companies. These sanctions are likely to have a noticeable impact on Russia’s longer-term development of its significant shale and Arctic resources, as well as on existing projects that need substantial investment, such as the Vankor field. More recently, additional U.S. and EU sanctions have been applied, raising the possibility of larger and earlier impacts on development and production in Russia’s energy sector.